ev tax credit 2022 california

Updated 342022 Latest changes are in bold Other tax credits available for electric vehicle owners. EV Tax Credit 2022.

We are financial advisors in La Jolla CA.

. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. And 4500 to 7000 for fuel cell electric vehicles. CVRP offers vehicle rebates on a first-come first-served basis and helps get the cleanest vehicles on the road in California by providing consumer rebates to reduce the initial cost of.

0 1 minute read. In this blog we will discuss what the credit is how it works and more. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

The state has lowered its max MSRP limit for eligible EVs to 45000 from 60000 for passenger cars. The rebate for most Californians for the purchase or lease of an electric vehicle can be up to 4500 depending on the vehicle -- and up to 7000 for low income residents. So now you should know if your vehicle does in fact qualify for a federal tax credit and.

83 rows Last updated March 10 2022. How to Claim the Electric Vehicle Tax Credit. The base minimum credit is increased to 5000 in 2026 Senate version or 4000 in 2022 House version.

Updated March 2022. The Build Back Better bill would give EV buyers a 7500 tax credit through 2026 to charge up sales. Installation of specified electric vehicle supply equipment or direct current fast chargers or both in a covered multifamily dwelling or covered nonresidential building.

If you qualify for. The credit amount will vary based on the capacity of the battery used to power the vehicle. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500.

As it stands now the current EV tax credit gives a base amount of 2500 for a four-wheel vehicle propelled by a battery at least a 4 kWh battery and is charged by an external source ie plug-in. For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 4000 credit. 2000 to 4500 for battery electric vehicles.

That being said California is giving credits to EV owners for an electric car home charger. 500 per Level 2 vehicle supply equipment and 2500 per direct current fast charger. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

But the following year only electric vehicles made in. California is lowering its MSRP limit and income cap for EV subsidies which offers 2000 USD for EVs and 1500 for plugin hybrids according to Green Car Reports. Taxpayers may receive up to 7500 as a federal tax credit for electric cars in 2022.

If you lease your EV the tax credit goes to the manufacturer. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The California EV Rebate Overview.

A qualified taxpayer would be allowed a credit of. For those that qualify Besides the generous credit for a LEVEL 2 home charger electric car owners can also qualify for a free HOV sticker. Since 2010 the Clean Vehicle Rebate Project has helped get over 350000 clean vehicles on the road in California.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. The electric vehicle tax credit has finally been made more accessible to taxpayers with the ability to claim up to 12500.

Please subscribe to our newsletter to receive updates related to California tax legislative and economic themes that may impact you. Whether you live in California or anywhere else in the United States the federal government will give electric car owners a tax credit of up to 7500. The best part about this tax credit is that its fully refundable.

Note that the federal EV tax credit amount is affected by your tax liability. Bill Analysis Bill Number. Ev charger tax credit 2021 california Sunday February 27 2022 Edit The goal of the CalCAP Electric Vehicle Charging Station Program is to expand the number of electric vehicle charging stations installed by small businesses in California.

Get up to 7000 to purchase or lease a new plug-in hybrid electric vehicle PHEV battery electric vehicle BEV or a fuel cell electric vehicle FCEV. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

April 6 2022 1144 PM. A qualified taxpayer would be allowed a maximum credit for installations during the taxable year of. Unlike the federal tax credit the California rebate comes in the form.

Funds for this program may become exhausted before the fiscal year ends but applicants will be placed on a rebate waiting list in this case. Californias MSRP limit on trucks and SUVs will remain at 60000. 500 per Level 2 or higher electric vehicle supply equipment installed during the taxable year and.

These amounts are for Federal tax credits effective January 1 2020 and California CRVP rebates effective December 3 2019 when several changes were made to that program. Plug-in hybrids get 1000 battery-electric cars can get a 2000 rebate and hydrogen fuel-cell cars are eligible for 4500. Well many EV owners are not aware of the benefits they can potentially rate for being an electric car owner.

The following table shows the Federal tax credit and California CRVP rebate amount available for BEVs and PHEVs currently for sale in the US. The exact amount of tax credit that you qualify for will depend on the type of electric car that you are driving. This incentive covers 30 of the cost with a maximum credit of up to 1000.

This California EV rebate typically awards between 1000 and 3500 for plug-in hybrids. Kyle Edison Last Updated.

California Electric Vehicle Exports Already Valued At 3 Billion In 2018 Expected To Hit 3 4 Billion In 2019

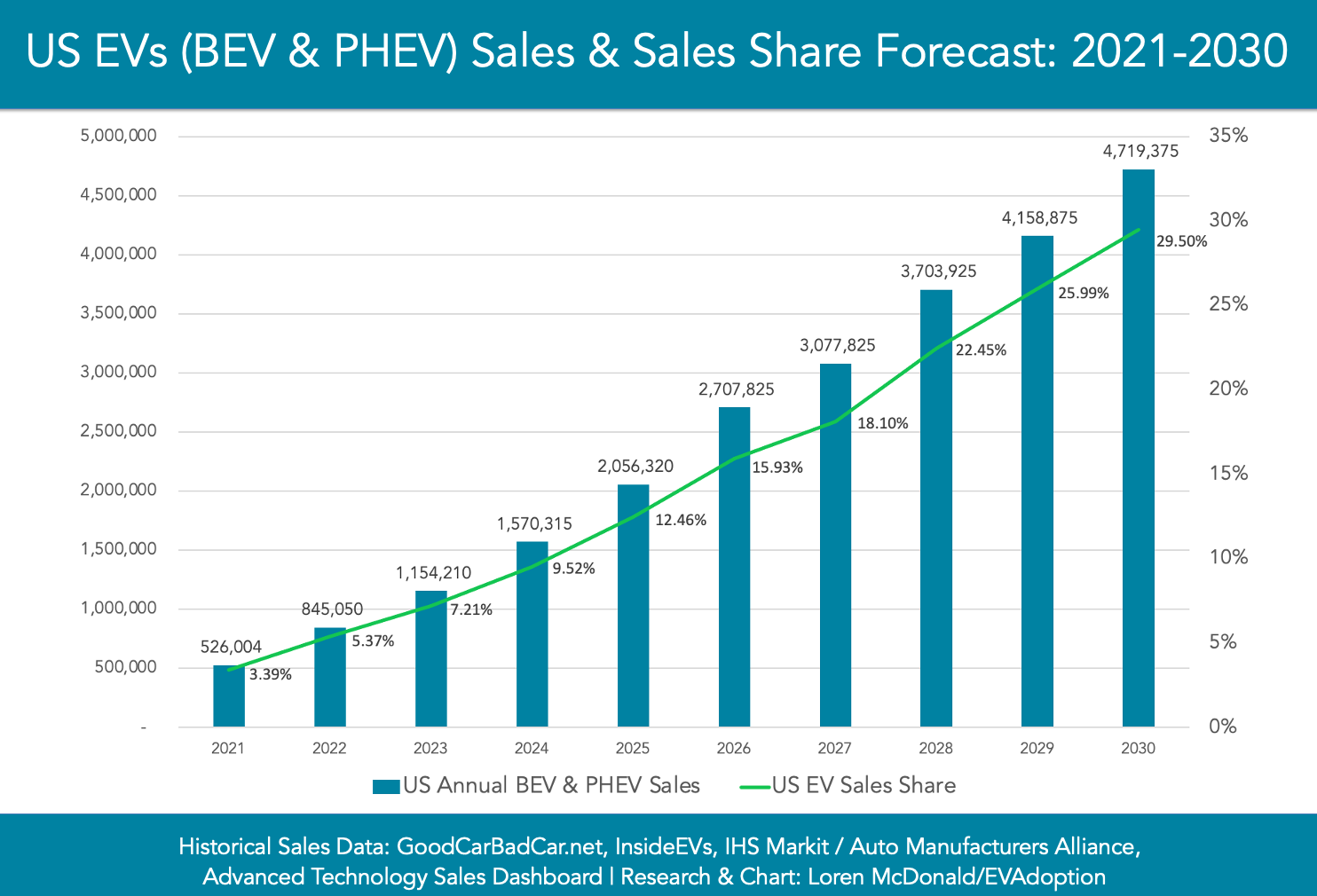

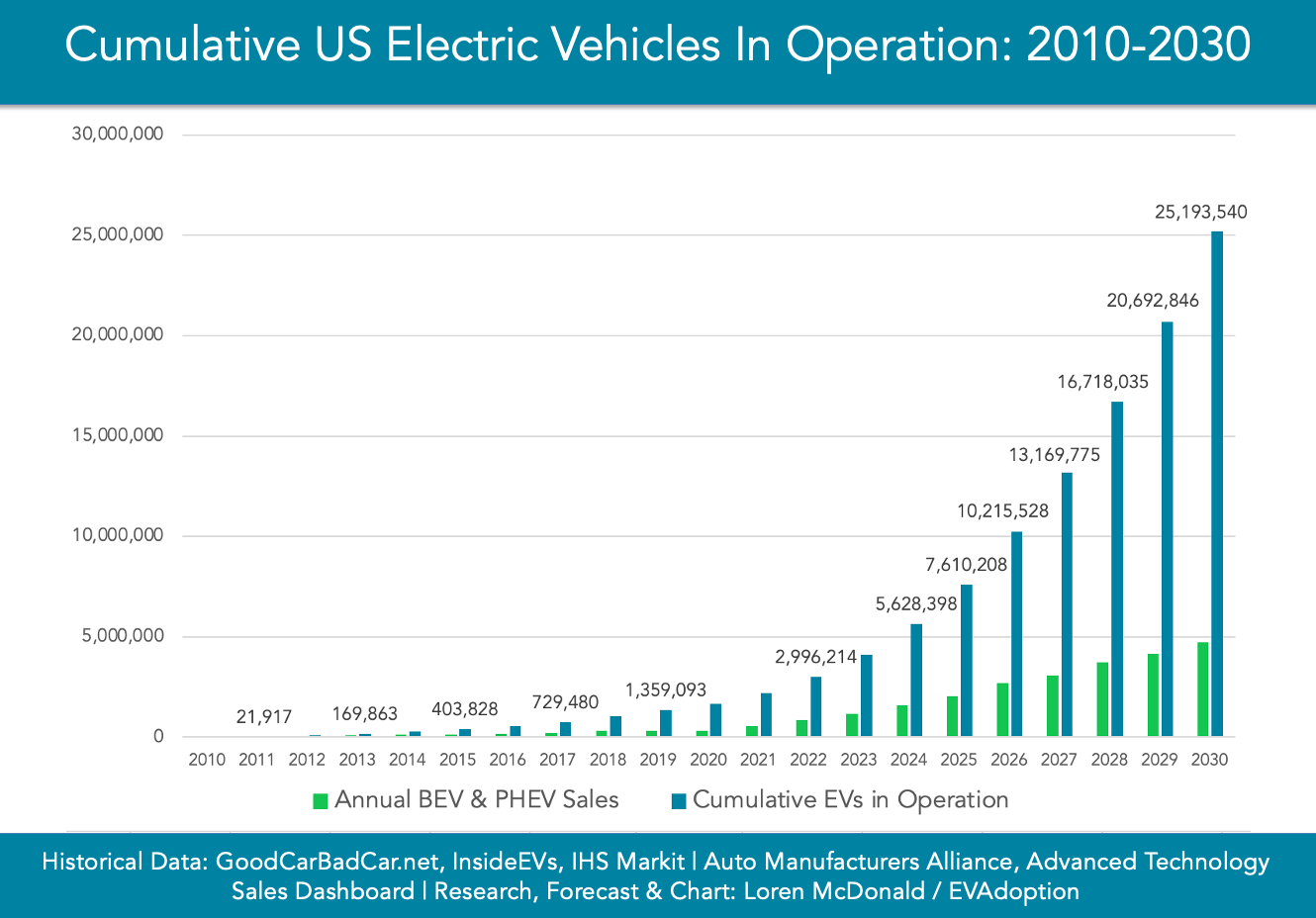

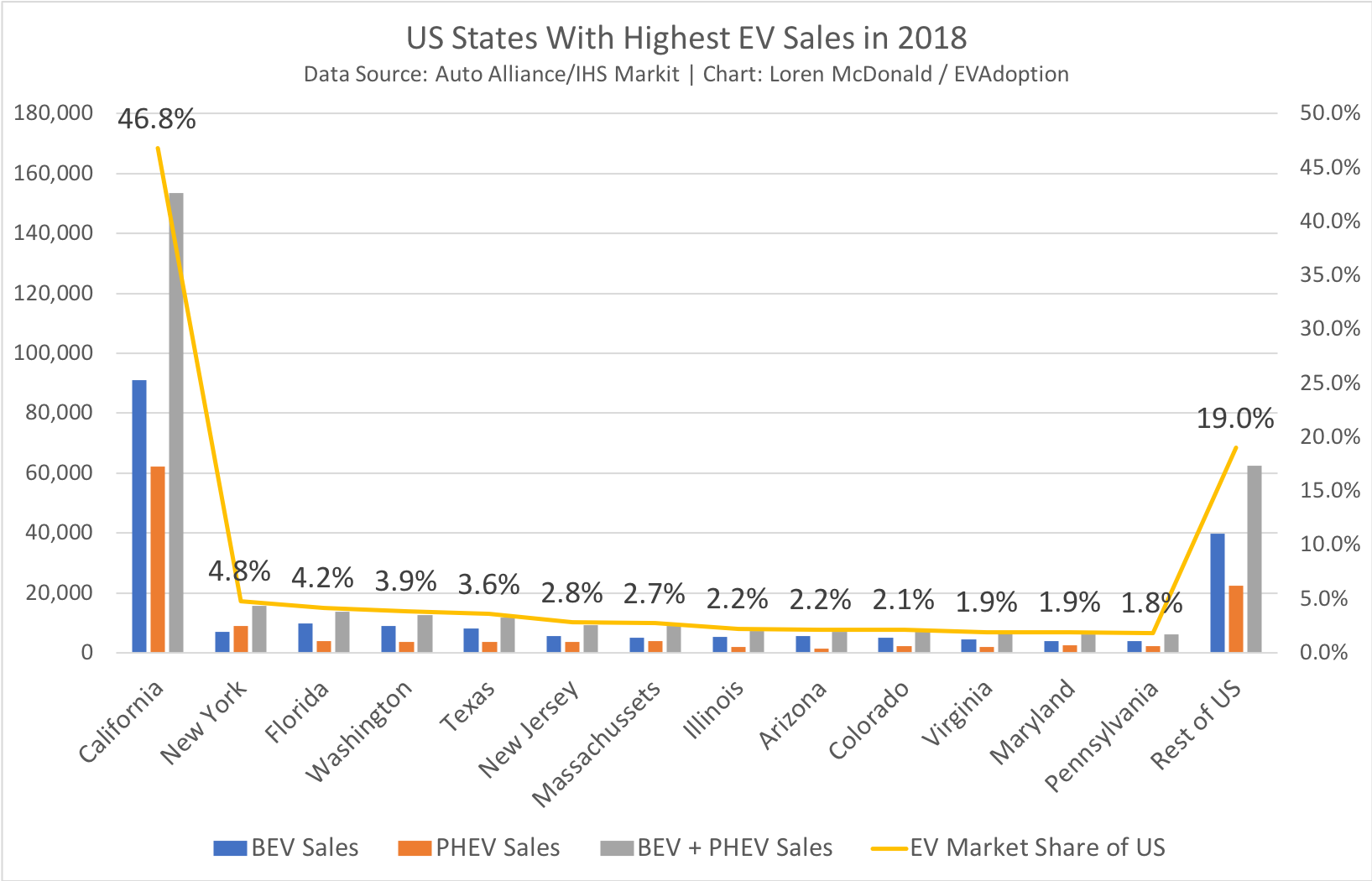

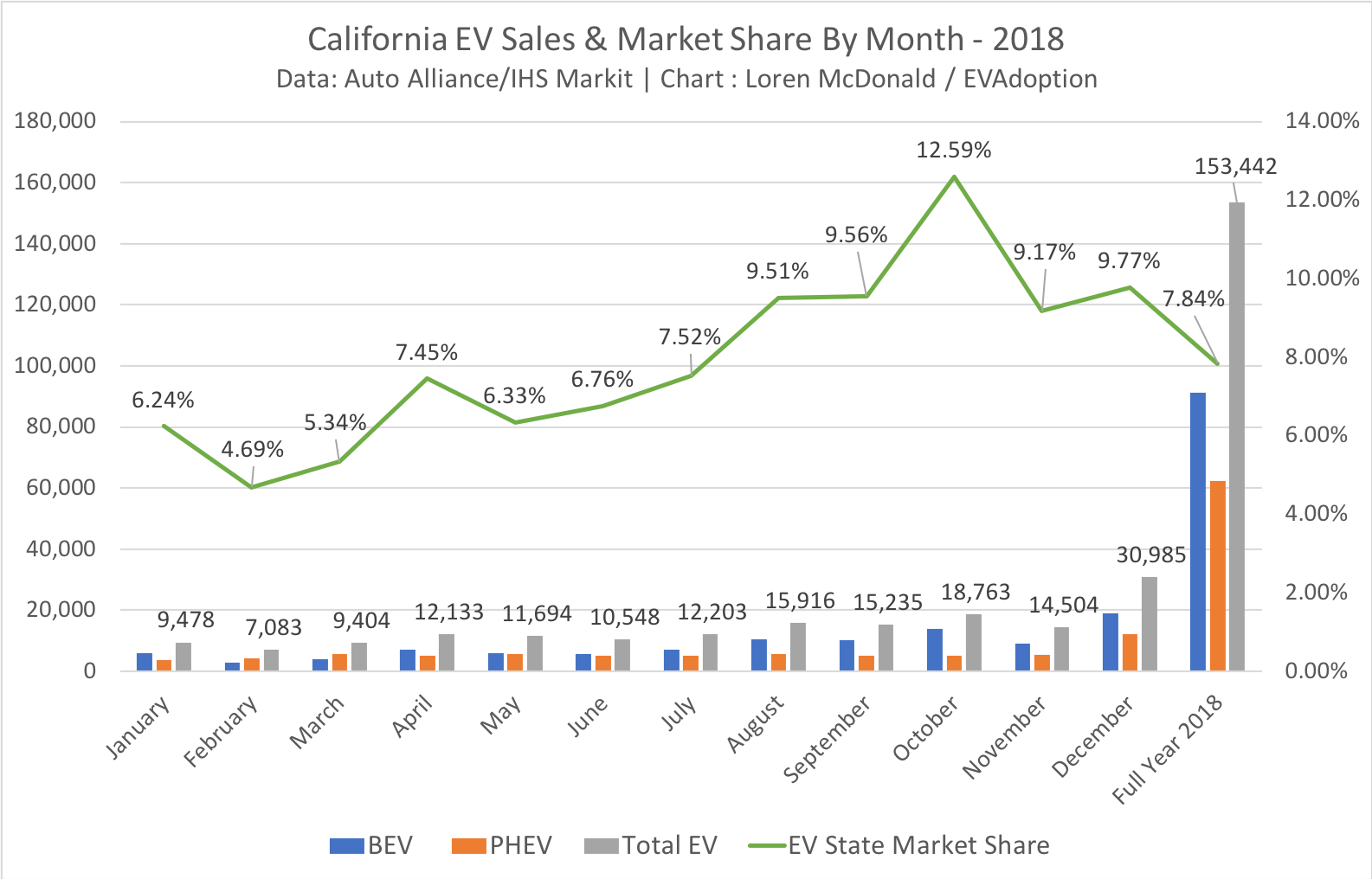

Ev Market Share California Evadoption

Southern California Edison Incentives

Mce Rebates For Your Electric Vehicle

Tesla Cut From California Ev Rebate Program After Price Hikes

Latest On Tesla Ev Tax Credit March 2022

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Ev Incentives Ev Savings Calculator Pg E

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

.jpg)

Latest On Tesla Ev Tax Credit March 2022

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

How Electric Vehicle Tax Credits Work

Us Ev Sales Tumble In 2020 But Ev Load Increases With More Charging Stations S P Global Commodity Insights

The Electric Vehicle Rebate In California And Other Incentives Coltura Moving Beyond Gasoline